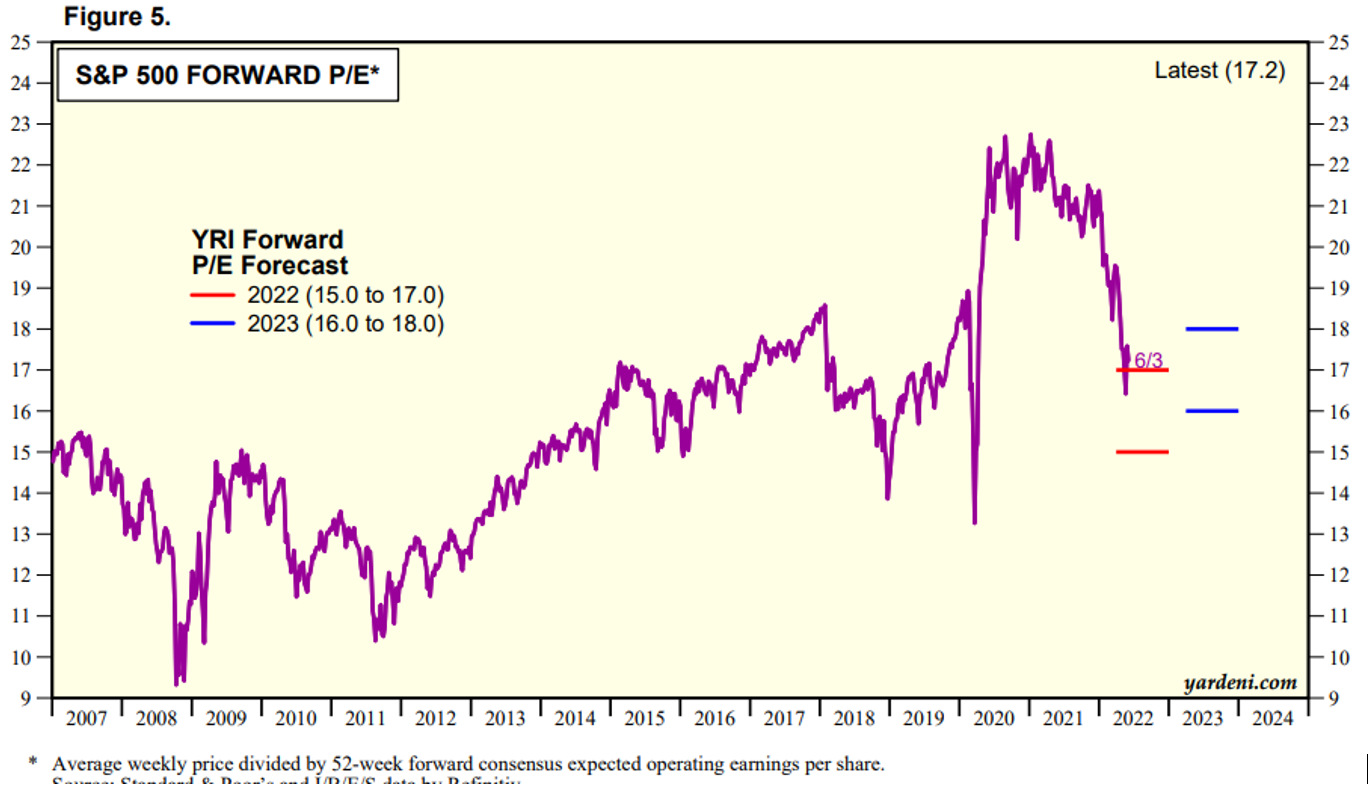

Market valuations are cheaper.

That is a prime argument for bulls on why now is a great time to buy. The S&P traded at approximately 22x earnings through much of 2021. The decline in markets year-to-date has lowered that to around 17x as we drift towards Q2 earnings.

Yardeni Research P/E Chart:

The problem with the current valuation is that investors need to identify the “real” 2023 SPX EPS. Current projections are for approximately $249 which equates to 17x earnings, a reasonable historic valuation of 17.5x. No one believes companies will hit current earnings estimates. The market expects to see companies’ lower outlooks given the economic backdrop.

This brings us to an important area of the markets: Pre-Announcement season. This is generally a period about two weeks ahead of the primary earnings season when companies provide earnings warnings to the market.

Snap, Inc (SNAP) started the engine up early when it lowered it’s outlook on May 23 after the market close. Microsoft (MSFT) followed suit when it cut its EPS outlook on June 2. Given the number of variables around inflation costs and transportation, more companies are expected to issue warnings thanks to margin compression.

Lower earnings lead to major questions about valuations. If we see the SPX EPS consensus fall from $249 to $230, then that forward earnings valuation rises to around 18x. This would contain upside potential in the markets and hurt the bull valuation argument.

Trading sentiment around these pre-announcements should be monitored closely. Here is a look at some of the early announcements and how the stocks have performed.

Target (TGT)

Target rattled markets this morning as it updated its Q2 outlook just 19 days after its initial forecast. The company projects its Q2 operating margin to be approximately 2%. The prior outlook was for the margins to be in a “wide range centered around our first quarter rate of 5.3%, well below where we’d expect to operate under normal circumstances”.

For the second half of the year, the company expects its operating margin to be approximately 6% which is in line with its prior FY23 forecast. This suggests that the full-year op margin will run around 4.8%, well below the company’s long-term target of 8%+.

The company continues to deal with inventory issues discussed on its Q2 earnings call. This is not necessarily a surprise as much as it provides further clarity to the market.

Target announced several actions in the quarter including additional markdowns, removing excess inventory, and canceling orders. TGT will open additional distribution centers around U.S. ports to provide flexibility.

The company is also pursuing aggressive options to control costs including ongoing work with vendors to help offset inflationary pressures, driving continued operating efficiencies, and reducing costs. This means that the pain felt at TGT will be passed around to vendors. It could also lead to a headcount reduction as the company did not provide clarity on how they would reduce costs.

The initial reaction to the news should not come as a surprise. Shares of TGT fell to $144 which marks its post-earnings lows set on May 24. It has been able to recover some of the early losses to push back to the $150s. It would be a good signal for the stock if it is able to hold support levels.

Microsoft (MSFT)

On June 2, MSFT lowered its EPS outlook to $2.24-2.32 from $2.28-2.35. Consensus expectations were for the company to report EPS of $2.35. MSFT lowered its revenue outlook to $51.94-52.74 billion from $52.4-53.2 billion vs the $52.9 billion consensus.

The primary reason for the warning was due to FX headwinds. Simply put, a strong dollar impacts multinationals who log costs in USD terms while generating revenue in currencies that are underperforming the greenback.

Shares of MSFT tumbled from $274 to the $263 area. The stock was able to settle and regain early losses, pushing back into positive territory on the same day.

The primary reason for the bounce-back was the idea that the warning was due to FX issues rather than any operational or demand worries. A key differentiator for the markets.

The takeaway here is that other multinationals are expected to provide similar warnings. Remember, Salesforce Inc (CRM) lowered its FY23 outlook two days earlier for the very same reason. This is another headwind to that forward earnings valuation.

Union Pacific (UNP)

The rail play chimed in with its own forecast this morning. Few realized it as it was overshadowed by the TGT news.

UNP cut its operating ratio (a key metric of profitability for rails) this morning. UNP reaffirmed that it expects to achieve FY22 operating ratio improvements on a year-over-year basis. However, increased pressure from fuel prices and other cost inflation as well as higher network costs will pressure margins below the original forecast of mid-60%.

UNP now expects all-in inflation to run around 4% for the year.

Shares of UNP fell approx. 4% in reaction to the announcement. The stock hit $217 in the pre-market but held its ground. It has now reversed higher and is trading in positive territory.

Snap Inc (SNAP)

On May 23, SNAP announced that it is likely to report Q2 revenues and adjusted EBITDA below the low end of its prior guidance due to further deterioration of the macroeconomic environment.

The company stated, “since we issued guidance on April 21, 2022, the macroeconomic environment has deteriorated further and faster than anticipated”.

Shares crumbled following the announcement. Investors were concerned that the business had fallen so precipitously as the company had provided its Q2 outlook just one month earlier.

The entire digital advertising space sold off in reaction. A few names bounced back as there was an argument about this being a company-specific, not an industry issue.

The stock crated, falling from $24 to $12. However, shares have stabilized at these levels and are up approximately 20% as they push to $15.40 today.

Bottom Line

Pre-announcement season continues to roll out. We will watch the warnings closely. The most important aspect for the short term is the bounce backs we are seeing in companies’ warnings. All four names discussed above are well off the initial reaction lows. This suggests that near term, the bulls will maintain control of the markets.

We will see if that continues as we head closer to the Q2 earnings season which kicks off in the middle of July. The valuation argument will continue to take a hit as markets reassess outlooks. The key for the market will be if participants see Q2 as a blip on longer-term trends or if the tighter margin environment will persist for another couple of quarters.