Russia’s invasion of the Ukraine has changed the tenor of International politics. The transgression marks the biggest military conflict on Europe’s continent since World War II.

Over the past 80 years, Europe refrained from arms races following two devastating wars. That may have changed.

The European Union took unprecedented action by sending $500 million in military aid to Ukraine. This marked the first time the EU has provided military to a country during a conflict.

German Chancellor Olaf Scholz said in a speech Sunday that Germany would increase its defense budget in response to the invasions. He called Russia’s action “a turning point in the history of our continent”. He added that it is clear we need to “invest significantly more in the security of our country”.

The United States has no intention of being left flat footed as Senate Republican Leader Mitch McConnell says the next Biden budget request must raise defense spending by at least 5% above inflation.

In 2014, when Russia annexed the Crimea, NATO announced a defense spending goal of 2% of GDP per nation. Truist Financial Group believes the organization has fallen short of that goal by $40-41 billion. The firm projects that, if NATO spending levels continue current spending levels there will be a cumulative defense spending gap of $334 billion through 2026. Closing that gap would be a massive tailwind for the defense space.

Investors are piling into Aerospace and Defense names given this backdrop. The iShares Aerospace & Defense ETF (ITA) is up 11% in February, its best month since March of 2021. We want to take a closer look at the ETF and see if there is still opportunity.

The investment objective of the ITA is to track the investment results of an index of U.S. equities in the aerospace and defense sector. Its benchmark is the Dow Jones U.S. Select Aerospace and Defense Index.

It is market cap weighted, meaning that components are weighted according to the total market value of their outstanding shares.

The Expense Ratio is relatively cheap at 0.42%. This means if you invest $10,000 it will cost you $42 per year. It does pay a Distribution Yield, the annual payments made to shareholders, of 0.82% so investors can collect a small yield.

There are 33 holdings in the ETF. The Top 10 holdings make up 77% of the ETF. This is not particularly diverse as aerospace and defense is a high barrier to entry.

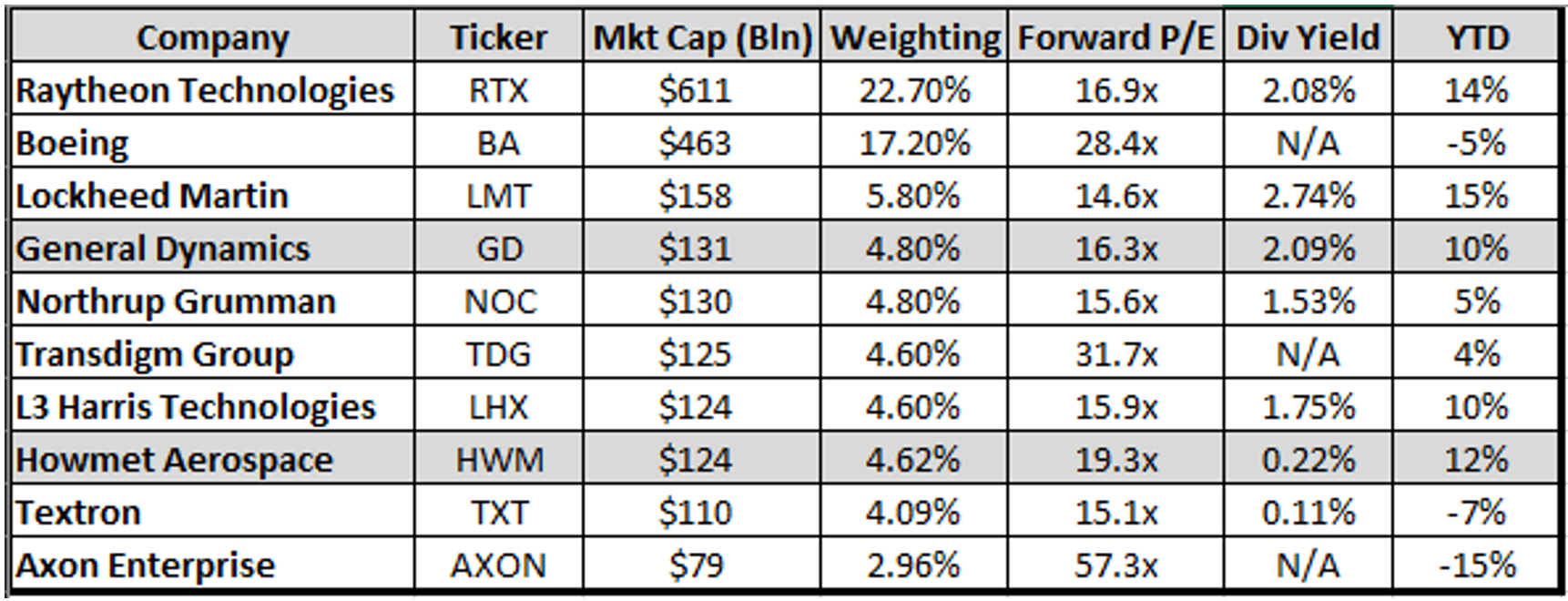

Here are the Top 10 holdings in the ITA along with the market cap, ETF weighting, forward earnings valuation, dividend yield and tear-to-date price performance:

RTX makes up a significant portion of this ETF at 22.7%. BA is second with a 17% weighting. Simple math tells us that this is a whopping 40% of the ETF.

The BA underperformance has been a drag on the overall group. BA has had its fair share of negative press with its 737 MAX issues. BA presents a lot of upside potential, but it could take a few quarters for performance to return.

Perhaps, RTX sets up as a better individual play? You basically buy a quarter of the ETF by simply adding this name to your portfolio.

The stock is up 14% tear-to-date, making it the second strongest performer in the top 10, trailing only LMT. However, shares of RTX remain cheap trading at about 17x forward earnings.

Shares of RTX came under pressure after providing a weaker for FY22 in its Q4 earnings report. I do not believe forward sales will be a concern. Many saw the guidance as being conservative which helps explain the quick bounce back.

RTX posted strong free cash flow, an important metric in today’s market, which represents a yield of 8%. The company has low leverage with a debt to EBITDA of approximately 2.1x. Its defensive business was steady in the quarter with a book to bill of 1.02x.

I think we are all in agreement that the key tailwinds for this group start to recede. But with growing concerns over China and Taiwan, it is unlikely that this changing world order will take shape overnight. That means money should continue to flow into this space.

Investors will continue to park money in the space. Taking a deeper dive suggests owning some of these individual names could be a better way to play the move.