By Jody Godoy

(Reuters) -Archegos Capital Management founder Bill Hwang on Wednesday pleaded not guilty to charges of fraud and other financial crimes over the meltdown of his New York family office which left banks with roughly $10 billion in losses.

Hwang entered the plea at an initial appearance in Manhattan federal court on Wednesday afternoon after his arrest earlier in the day.

U.S. Magistrate Judge Jennifer Willis ordered Hwang released on $100 million bond, secured by two properties and $5 million cash bail.

At the hearing, Archegos Chief Financial Officer Patrick Halligan also pleaded not guilty to racketeering conspiracy and was released on $1 million bond. Archegos, which had $36 billion in assets, collapsed last year after defaulting on margin calls triggered by the unraveling of highly leveraged equity derivative trades.

Among the biggest fund blow-ups in years, the scandal roiled Wall Street, sparked a fire sale in stocks including ViacomCBS and Discovery Inc, and caused Credit Suisse, Nomura Holdings and Deutsche Bank, among other lenders, to lose billions on their trades with Hwang.

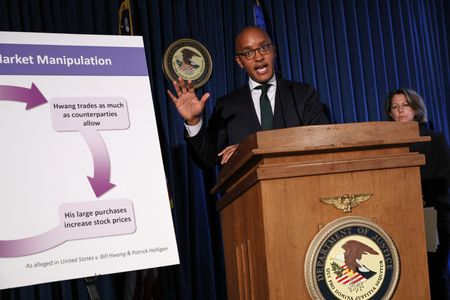

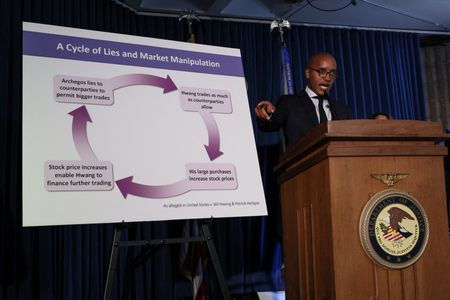

On Wednesday, U.S. authorities alleged that Hwang, who denies wrongdoing, amassed his huge equity exposures by lying to the banks in order increase Archegos’ credit lines and then used derivatives he traded with them to manipulate the underlying shares and ratchet up his returns.

(Reporting by Niket Nishant in Bengaluru and Jody Godoy in New YorkAdditional reporting by Megan Davies and Elizabeth Dilts in New York, Chris Prentice in Washington and Noor Zainab Hussain in BengaluruWriting by Michelle Price and Luc CohenEditing by Chizu Nomiyama, Elaine Hardcastle, Matthew Lewis and Cynthia Osterman)