ISTANBUL (AP) — Turkey’s central bank kept its main interest rate unchanged for a fifth month running on Thursday despite an annual inflation rate of nearly 70%.

The bank said it would keep its policy rate “constant” at 14%, arguing inflation was driven by geopolitical developments and the “temporary effects of pricing formations.” The bank set its expectation for disinflation to begin following measures for price stability and the resolution of an ongoing regional conflict, an apparent reference to Russia’s war in Ukraine.

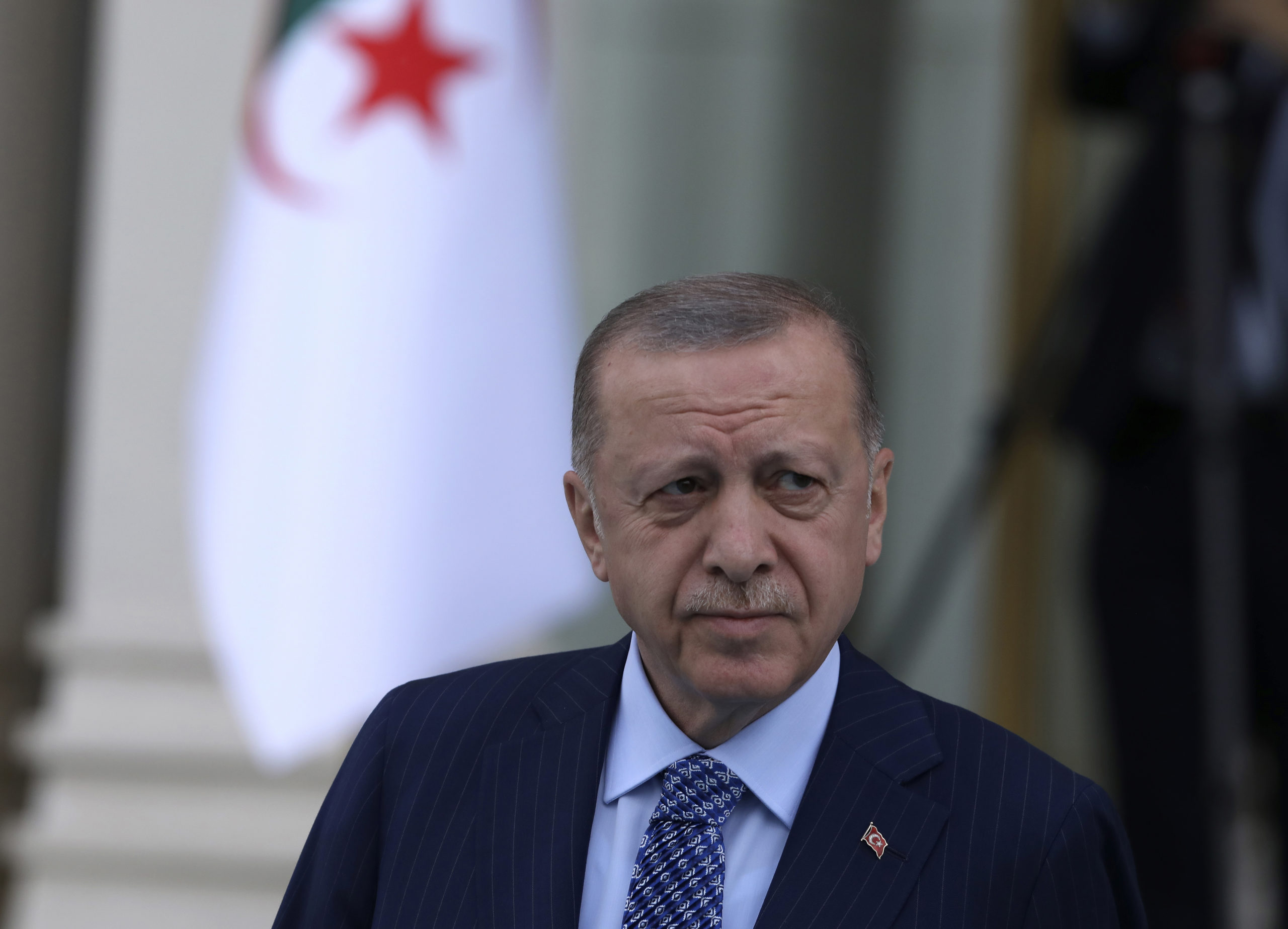

The decision was in line with President Recep Tayyip Erdogan’s opposition to high borrowing costs in a bid to boost growth, investment and exports. The Turkish leader insists that high borrowing costs cause inflation — a position that contradicts established economic thinking.

Turkey’s central bank has cut rates by five percentage points since September — down to 14% —despite high inflation rates before pausing them since January. The series of rate cuts last year triggered a currency crisis and rising prices which have been aggravated by Russia’s invasion of Ukraine and rising energy price rises.

Yearly inflation hit 69.97% in April, deepening the squeeze on households that were already struggling to purchase basic goods.

The central bank’s decision comes as the Turkish lira resumed its decline. The lira has lost about 18% of its value against the dollar since the beginning of the year. The lira’s depreciation was slowed from a rapid fall in December when the government introduced unconventional measures instead of raising interest rates. The lira lost about 44% of its value against the dollar last year.

In an effort to soften the blow on households, the government has implemented tax cuts on basic goods.