1

1 1

1

By Echo Wang

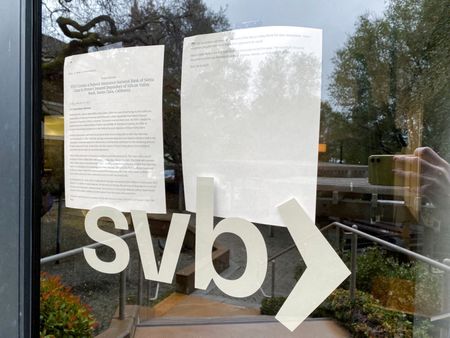

(Reuters) – In the middle of last week, Moody’s Investors Service Inc delivered alarming news to SVB Financial Group, the parent of Silicon Valley Bank: the ratings firm was preparing to downgrade the bank’s credit.That phone call, described by two people familiar with the situation, began the process toward Friday’s spectacular collapse of the startup-focused lender, the biggest bank failure since the 2008 financial crisis.

Friday’s collapse sent jitters through global markets and walloped banking stocks. Investors worry that the Federal Reserve’s aggressive interest rate increases to fight inflation are exposing vulnerabilities in the financial system.

Details of SVB’s failed response to the prospect of the downgrade, reported by Reuters for the first time, show how quickly confidence in financial institutions can erode. The failure also sent shockwaves through California’s startup economy, with many companies unsure how much of their deposits they can recover and worrying about how to make payroll.

The Moody’s call came after the value of the bonds where SVB had parked its money fell due to the higher interest rates.

Worried the downgrade could undermine the confidence of investors and clients in the bank’s financial health, SVB Chief Executive Greg Becker’s team called Goldman Sachs Group Inc bankers for advice and flew to New York for meetings with Moody’s and other ratings firms, the sources said.

The sources asked not to be identified because they are bound by confidentiality agreements.

SVB then worked on a plan over the weekend to boost the value of its holdings. It would sell more than $20 billion worth of low-yielding bonds and reinvest the proceeds in assets that deliver higher returns.

The transaction would generate a loss, but if SVB could fill that funding hole by selling shares, it would avoid a multi-notch downgrade, the sources said.

The plan backfired.

News of the share sale spooked clients, primarily technology startups, that rushed to withdraw their deposits, upending the capital raising. Regulators stepped in on Friday, shutting down the bank and putting it in receivership.

SVB, Goldman Sachs and Moody’s representatives did not immediately respond to requests for comment.

THE UNRAVELING

As SVB executives debated when to proceed with the fundraising, they heard from Moody’s that the downgrade was coming this week, the sources said.

SVB sprang into action in the hopes of softening the blow.

The bank lined up private equity firm General Atlantic, which agreed to buy $500 million of the $2.25 billion stock sale, while another investor said it could not reach a deal on SVB’s timeline, the sources said.

By Wednesday, SVB had sold the bond portfolio for a $1.8 billion loss.

Moody’s downgraded the bank, but only by a notch because of SVB’s bond portfolio sale and plan to raise capital.

Ideally, the stock sale would have been completed by before the market opened on Thursday, to avoid the sale being jeopardized by any declines in SVB’s shares once news of the sale got out. But the sources said that was not an option given the tight schedule.

SVB had not done the preparatory work needed to sign confidentiality agreements with investors who would commit to a deal of such a size. Its lawyers advised the bank that investors would need at least 24 hours to digest new downbeat financial projections and complete the sale, the sources said.

Reuters could not determine why SVB did not start those preparations earlier.

SVB’s stock plunged on news of the share sale, ending Thursday down 60% at $106.04. Goldman Sachs bankers still hoped they could close the sale at $95, the sources said.

Then news came of venture capital firms advising startups they had invested in to pull money out of Silicon Valley Bank for fear of an imminent bank run.

This quickly became a self-fulfilling prophecy: General Atlantic and other investors walked away and the stock sale collapsed.

General Atlantic did not respond to a request for comment.

California banking regulators closed the bank on Friday and appointed the Federal Deposit Insurance Corporation (FDIC) receiver. The FDIC will dispose of its assets.

In the past, the regulator has struck deals quickly, sometimes over just a weekend, something that some experts said could happen with SVB.

(Reporting by Echo Wang in Washington; Editing by Greg Roumeliotis and William Mallard)