1

1 1

1

By David Morgan

WASHINGTON (Reuters) – A Republican bill to prevent pension fund managers from basing investment decisions on factors like climate change cleared Congress on Wednesday, setting up a confrontation with President Joe Biden, who is expected to veto the measure.

The U.S. Senate voted 50-46 to adopt a resolution to overturn a Labor Department rule making it easier for fund managers to consider environmental, social and corporate governance, or ESG, issues for investments and shareholder rights decisions, such as through proxy voting.

The outcome highlighted Republicans’ willingness to oppose their traditional allies in Wall Street and corporate America that adopt what party lawmakers characterize as “woke”, liberal practices.

Two Democratic senators, Joe Manchin and Jon Tester, voted with Republicans. Both face reelection in Republican-leaning states in 2024. The Republican-controlled House of Representatives passed the bill on Tuesday.

The White House has said Biden will veto the measure.

Republicans claim the rule, which covers plans that collectively invest $12 trillion on behalf of 150 million Americans, would politicize investing by allowing plan managers to pursue liberal causes, which they say would hurt performance.

Senate Democratic leader Chuck Schumer accused Republicans of interfering with private investing decisions, saying on the Senate floor that they are “forcing their own views down the throats of every company and every investor.”

The Labor Department regulation prohibits plan managers from subordinating financial interests to other objectives, according to a Harvard Law School analysis, which found it makes largely cosmetic changes to a more restrictive rule set in place under former President Donald Trump.

Republicans said their resolution would prevent fund managers from basing investment decisions on ESG factors primarily. But they acknowledged that it would not stop funds from considering ESG issues altogether.

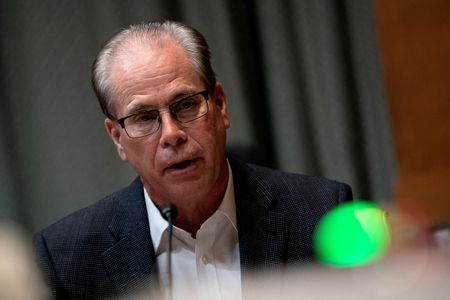

“This just simply says that the primary criterion has to be the financial return on investment,” said Republican Senator Mike Braun, who sponsored the bill.

The Labor Department said the Trump-era rule failed to account for the positive impact that ESG investing can have on long-term returns. Industry has been split on the Biden rule, with fossil-fuel companies opposed and other businesses voicing support.

In 2022, ESG funds were hit by fallout from the Ukraine war, tumbling financial markets and U.S. political backlash against the industry. As a result, those funds lagged non-ESG funds for the first time in five years after fossil fuel shares – which they typically shun – soared.

Republicans used a tool called the Congressional Review Act that allows them to bypass the customary 60-vote Senate threshold to challenge the Labor Department rule.

They are expected to mount similar efforts on other issues in the coming months as the 2024 presidential campaign gets into full swing.

(Reporting by David Morgan; additional reporting by Daniel Wiessner in Albany, New York; editing by Andy Sullivan, Nick Zieminski and Bill Berkrot)