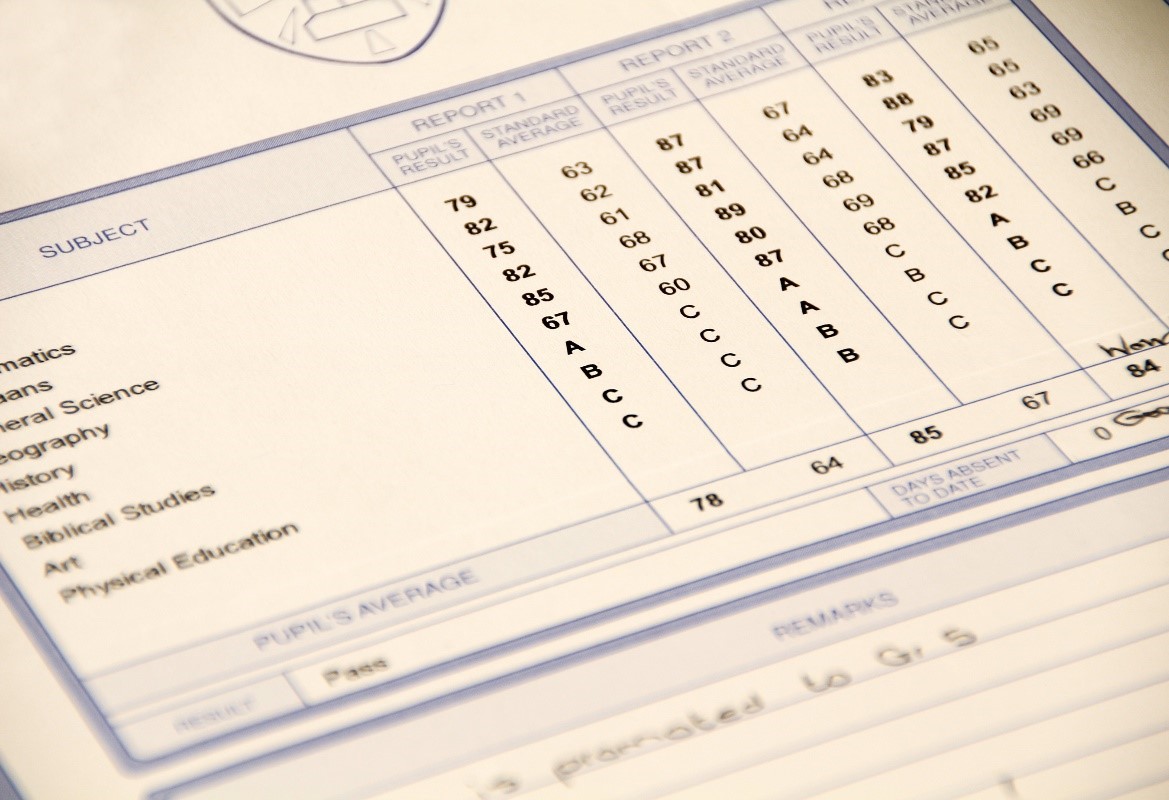

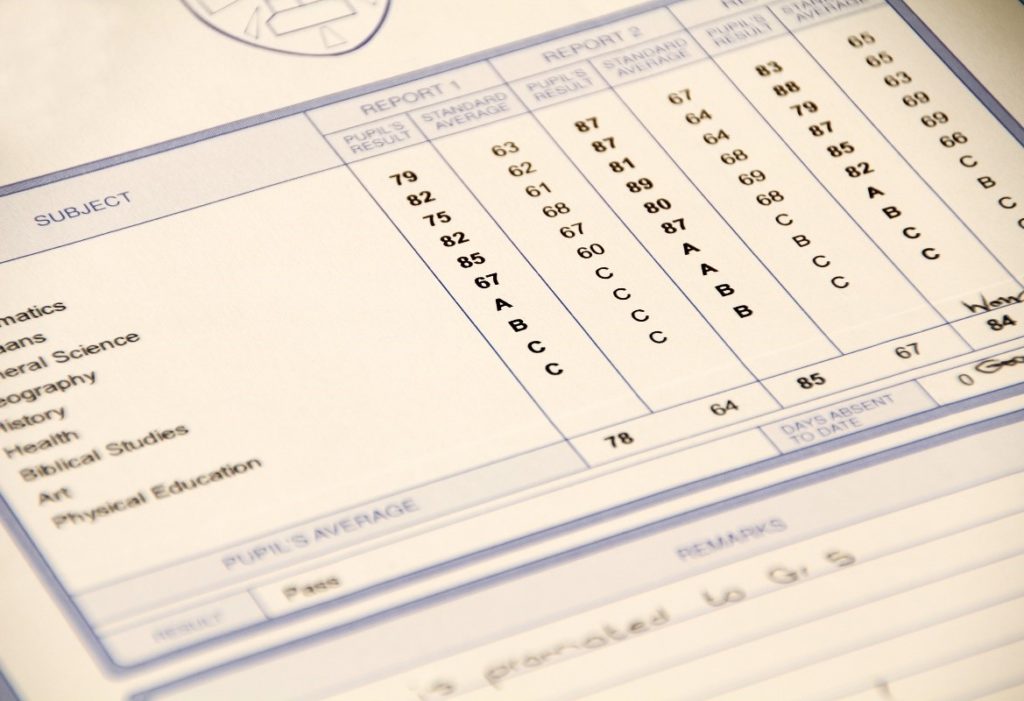

The market prepares for Q2 earnings season. There is plenty of uncertainty facing investors as companies’ hand in report cards. Investors would like to see some clarity on the economic situation.

Expectations are low which makes it easier for companies to surpass analyst consensus numbers. Q3 and second half outlooks will garner plenty of attention. Forecasts should be conservative given the headwinds. The question for market participants is how much has been priced into stocks?

The reaction to Micron’s (MU) guidance is encouraging and suggests some bad news has been accounted for. However, one stock does not make for a trend. We will want to see the cumulative impact from earnings and commentary to get a true assessment.

A lot of the names reporting this week are sitting on key support levels. An ability to absorb cautious outlook and hold support would be an important step in a potential bottoming process.

Banks will be a key read for investors this week. The group will provide a broad view of the consumer and corporate loan demand. We will also get reports from the semiconductor, airline, staples, and healthcare.

Names to watch include:

- Delta Airlines (DAL)- Wednesday morning, DAL will kick off an important earnings season for the airlines. The group has been in the news as ‘revenge travel’ has led to strong demand for the group. Pricing power has been evident with travelers willing to pay up for travel. However, there has been plenty of headlines of customers seeing nightmarish delays as these companies struggle to staff employees to service the uptick in demand. Naturally, the group is impacted by these high oil prices. Investors expect to see a strong earnings season from the group. The key will be watching commentary around demand and if it remains elevated heading into Q3 earnings. Shares of DAL have fallen 25% since the start of June. It is struggling to hold the $28-29 area into its print.

- Conagra (CAG)- The consumer staple is set to report Q2 earnings Thursday before the market opens. CAG will give us unique insight into the food service industry, a key area of inflationary pressure. Shares of CAG are up 3% year-to-date as investors have stayed in staples as a defensive play. CAG comes off a disappointing Q1 where it was able to report an in-line EPS and top sales expectations. However, the company did warn that it would miss 2022 revenue EPS expectations due to higher costs. FY 22 organic net sales growth is expected to be approximately 4% which was an uptick from the prior forecast of +3%. CAG trades at 14x forward earnings, making it cheaper than most of its peers that trade at 21x, and carries a dividend yield of 3.54%. The stock has rallied from $31 to $35 ahead of its earnings report. It will be difficult to hold these gains if company disappoints.

- Ericsson (ERIC)- Telecommunication plays spearheaded. ERIC did not take part in that rally. It is a poor chart as there are concerns that European stocks are set to miss expectations due to the lingering impact of Russia’s invasion of Ukraine. The earnings report will shed light on the 5G progress in Europe. We would also look for an update on the company’s acquisition of Vonage (VG). Shares of ERIC are fighting to hold the $7.30 level. This will set up as the key support level for market participants. The stock is cheap at 8.8x forward earnings and the stock is paying out a healthy dividend at 4.17%.

- P. Morgan (JPM)– It is a big week for the banks. J.P. Morgan is always a key bellwether for the group and the economy. Jamie Dimon put his bank front and center when he announced that they were preparing for a possible ‘hurricane’ meaning disruptions to the financial system had him cautious. This will put the focus on how JPM handles its balance sheet and its reserve build. Shares of JPM have been under pressure and are down 27% year-to-date. The stock now trades at 9x forward earnings and approx. 1.35x price to book which is cheap on a historical basis. It also offers a healthy dividend yield of 3.50%. $110 is setting up as a key level for support.

- Morgan Stanley (MS)- The investment bank was one of the clear winners in this year’s bank stress tests. MS announced that it would increase its dividend by 11% to $0.775 per share and would buyback $20 billion in common stock. This was one of the rare share buyback plans announced and suggests that MS’ balance sheet remains in pristine condition despite some of the broad market volatility. Its dividend yield sits at a healthy 3.65%. Shares have been under steady pressure in 2021 with the stock now down 21% YTD. The stock is attempting to hold the $75 level ahead of its report. An ample share buyback Program should help it hold.

- Taiwan Semi (TSM)– The world’s largest semiconductor company always bears watching. TSM is the top-weighted stock in the VanEck Semiconductor ETF (SMH), representing 10% of that index. TSM provides markets monthly revenue updates, so its results rarely catch markets by surprise. On July 8, TSM pre-announced revenue of NT$534 billion which was above the NT$519 billion consensus. Investors remain concerned that Q3 results may reflect a slow down in orders. This was highlighted in a recent Digitimes article which suggested clients are aggressively scaling back. If TSM guides Q3 revenue below consensus expectations than that will lead to speculation the semiconductor industry could seeing an inventory-driven cyclical peak. This would lead to a mid-cycle correction in the near-term. Shares of TSM are testing a key long-term trend line as it sits on the 200-weekly ($78) ahead of its report.

- BlackRock (BLK)– Asset management names have been under pressure. This is not a surprise as they are directly tied to the performance in stock and bond markets. Shares of BLK are down approximately 32% year-to-date. The stock is now trading at 15x forward earnings and carries a dividend yield of 3.15%. The company’s balance sheet remains in good shape which suggests its dividend is safe. Investors looking for a turnaround in the stock market should have BLK on their radar. We will want to listen to CEO Larry Fink on the company’s conference call to get an idea on what BLK’s clients are doing in these markets.

- Citigroup (C)– This is one of the cheapest bank stocks as it trades at 0.52x its book. That means investors see the valuation of this stock at half the total of assets it has on its books. Citi continues to struggle with its international exposure which makes up approximately half of its revenues. This has led volatility in results. The latest development is an investigation by the SEC looking for “enhanced” disclosures into the bank’s Russia business. This is another example of the bank’s risk management process coming under scrutiny. The bank’s credit card unit will provide us insight into the health of the consumer. The stock is cheap which has led investors into the name. The stock has held $45 support over the past four weeks. This is the key support area as we head into the print.

- PNC (PNC)– Investors will watch the superregional to get a read on the health of the consumer. The bank posted a solid round of results in Q1 as it handily beat bottom line expectations. It projected revenue growth of 9-11% and loan growth of 10% for this quarter. They may be lofty goals given the recent slow down in the economy. Raymond James downgraded the stock to Market Perform from Outperform ahead of these results. This suggests the firm is cautious about the upcoming quarter. Shares have been under pressure sliding from $225 at the start of the year to the current $160 area. The 200-weekly ($150) sits below as a key support level.

- S. Bancorp (USB)– RBC Capital recently cut its 2022 and 2023 estimates on USB to reflect lower profitability expectations. The bank has significant exposure to custodial deposits which can lean on earnings when the Fed tightens aggressively. UBS recently noted that the bank is one of the banks most sensitive to these rate hikes and the impact AOCI. Investors await the closing of the banks Union Bank acquisition. This was originally expected in Q2 but the timing has been pushed out as the move comes under tighter regulatory scrutiny. The stock is attempting to hold the $45 level ahead of earnings. Expectations are low for this name.

- United Health (UNH)– The Dow Jones index is a price weighted index. This means that UNH and its $500+ share price is the top weighted company in the Dow. It has a weighting of 9.64% and which can have a major impact. RBC Capital sees strength in the Medicare Advantage space given commentary throughout the quarter. This bodes well for UNH, Humana (HUM) and CVS (CVS). UNH’s chart looks great as it has climbed from $450 to the $500 range over the past couple of weeks. This may suggest some of the good news from earnings has been priced into shares.

- Wells Fargo (WFC)- WFC and bank of America (BAC) are the two largest consumer lenders and will garner plenty of attention. As with its peers, expectations are low heading into Q2 earnings. Analysts are projecting a 42% profit decline for the bank compared to a -25% decline at JPM and a 38% drop for C. WFC provided a relatively upbeat assessment of its business on June 14. The bank’s CFO Mike Santomassimo said that he felt “really good” about its Net Interest income outlook for 2022. He stated that he does not expect a reserve release due to the economic uncertainty. Trading revenue is expected to be up slightly from the prior year while mortgage activity was seeing a slowdown. Shares of WFC have slipped below the 200-weekly ($42.73) over the past couple of weeks. The stock is trying to hold around the $38 level.