1

1 1

1

M-I-C-K-E-Y M-O-U-S-E! Ah the joyous sound of children singing that song. This is one of the many reasons why the Mouse House is billed as “The Happiest Place on Earth”.

Investors may take umbrage with that statement. Shares of the company are down -45% from last year when it hit an all-time high and down -32% year-to-date.

Most of those losses occurred after Netflix (NFLX) posted a poor round of earnings on April 19. The NFLX miss led to calls of the “death of streaming”. Well, that may be a little extreme, let’s call it “peak streaming”.

Disney+ was expected to be a key driver for DIS. The idea of this growth engine dissipating and a potential recessionary environment around theme parks sent investors to the sidelines.

This is, arguably, not even the most concerning aspect of the company’s business. The backdrop of a political maelstrom in Florida led G.O.P. politicians to strip the company of its self-governing status. What will happen to the $1 billion in municipal bonds following this new law? How will this impact the Parks operations?

Disney stepped into the earnings confessional with all this fresh on investors’ minds. How did the Mouse House perform?

Disney reported Q2 earnings of $1.08 per share which missed estimates by 11 cents but was up 37% y/y. Revenues rose 23% y/y to $19.25 billion, below the expected $20 billion.

Excluding a one-time revenue reversal, resulting from the early termination of a licensing deal which is rumored to be around NFLX, revs would have been $20.3 billion. The bottom-line miss can be attributed to a higher-than-expected tax rate.

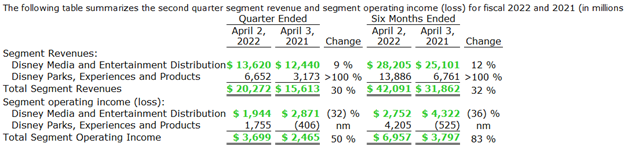

Total segment operating income was $3.70 billion, up 50% y/y and better than the $3.26 billion.

Disney Media and Entertainment revenues increased 9% y/y to $13.6 billion. Operating income from the segment declined 32% as the company ramped up content spend.

Direct-to-Consumer revenues (streaming services) for the quarter increased 23% to $4.9 billion and operating losses increased from ($600 million) to ($900 million). The increase in operating loss was due to higher losses at Disney+ and ESPN+ and lower operating income at Hulu.

Lower results at Disney+ reflected higher programming and production, marketing, and technology costs, partially offset by an increase in subscription revenue.

Lower results at ESPN+ were due to higher sports programming costs and a decrease in income from Ultimate Fighting Championship (UFC) pay-per-view events, partially offset by an increase in subscription revenue due to subscriber growth.

The decrease at Hulu was due to higher programming and production, marketing and technology costs, partially offset by subscription revenue growth and higher advertising revenue.

You can see the theme here- The company is building its streaming service and has some pricing power but the cost of content continues to outpace the pricing power.

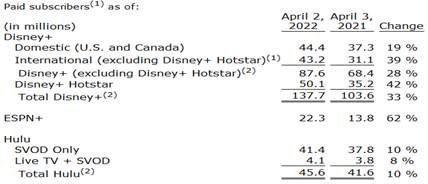

The company added 7.9 million to the Disney+ platform in the quarter. This was well above the 5 million expectations and stood in stark contrast to the Netflix (NFLX) performance. The company expects subscriber additions in the second half of the year to exceed first-half figures but suggested the difference would not be as large due to some pull-through.

The stock chopped lower during the conference call in response to this comment. Investors heard echoes of NFLX and headed for the exits.

Disney reiterated it expects 230-260 million subs on Disney+ by 2024. This is notable as Netflix (NFLX) stands at 222 million. Some are pointing to the recent NFLX results as “peak subs” for streaming businesses.

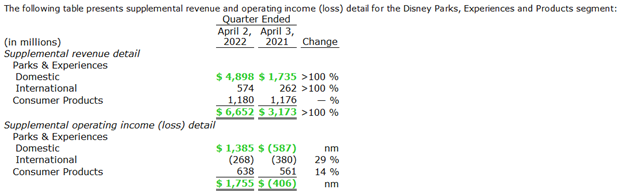

Parks, experience, and product revenues were $6.7 billion compared to expectations of $6.12 billion. Operating income was $1.76 billion, better than the $1.61 billion expected.

Domestic theme park revenue was $4.9 billion which nearly equaled the pre-pandemic peak. Operating income for Domestic was an impressive $1.4 billion.

The company warned of the impact COVID closures in Asia would have on the theme park business, projecting lower operating revenue from the segment in Q3.

The company kept clear of politics as it never mentioned the row in Florida. Amazingly, analysts did not even bring up the topic of who might be on the hook for the nearly $1 billion in municipal bonds. Conspiracy theorists’ heads must be spinning when it comes to the cozy analyst/company relationship theory.

Conclusion

Disney reported a solid performance but concerns over the long-term growth for streaming and recessionary fears will continue to weigh on sentiment.

The subscription beat was important, but we can see the company is burning cash to keep that momentum. We saw similar activity over at Netflix. One key difference is that Disney has the Parks segment which can help fund some of the content costs on the DTC side.

The question for the Parks performance is how sustainable is it as consumers battle inflationary pressures? The cost of going to Disney World is not cheap. If people are seeing those higher food bills will they pull back in some of the Travel and Entertainment spend we witnessed in the first quarter?

This does not even consider the geopolitical issues which the company (and analyst community) failed to address on the call.

Shares of DIS trade at approximately 18x forward earnings so it is not particularly cheap. It does not offer any capital return programs to entice investors.

The stock is coming in for a key test of the $100 psyche level. It remains down -1.28% while the broader market sees an oversold bounce. Chances are this stock will continue to meander around the $100 level until we see further evidence of how inflation impacts the consumer in Q2.

Longer-term investors should find this entry appealing. The company is arguably the best media stock to own given its platform of DTC products and ability to tie content and experiences together. You just need to be aware that you are in for a bumpy ride given some of the near-term headwinds.