1

1 1

1

By Hilary Russ

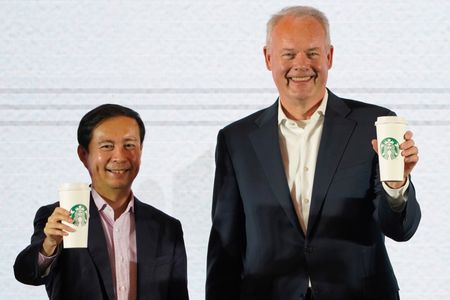

NEW YORK (Reuters) -Starbucks’ longtime former Chief Executive Officer Howard Schultz will return temporarily after Kevin Johnson said on Wednesday that he will retire from the role on April 4, as a unionization drive at U.S. cafes heats up.

Shares of the coffee chain surged 7% on the news.

Schultz is practically synonymous with the company he took over in 1987. He expanded it into a coffee behemoth that made venti cappuccinos a global phenomenon.

“Schultz is a revered leader and uniquely well-qualified to steward” the company, said Credit Suisse analyst Lauren Silberman. This will be his third tour of duty heading Starbucks.

The company said it would provide more information during its annual shareholder meeting later on Wednesday. The board expects to have selected a new leader by the fall, with help from executive search firm Russell Reynolds Associates, which it enlisted in 2021.

Johnson signaled to the board of directors a year ago that he might retire when the COVID-19 pandemic waned, he said in a company statement.

Johnson, who is 61, has been at Starbucks for 13 years, the last five as CEO.

After the pandemic shuttered Starbucks cafes around the globe, the company, under Johnson’s watch, said it would start building some smaller stores with less room for seating and more emphasis on to-go and drive-thru orders.

Customers also placed more orders through the Starbucks mobile app, but that has led to long lines and overworked employees in some areas.

UNION PUSH

That barista burnout, as well as accusations by some workers that they were not getting enough protection from the deadly virus when at work, contributed to a surge of union organizing in U.S. locations.

On Tuesday, a federal labor board accused Starbucks of unlawfully retaliating against two employees in a Phoenix, Arizona, cafe for trying to unionize their store.

The same day, a group of investors with $3.4 trillion under management urged the company to stop sending anti-union communications to its employees and to adopt a neutral policy towards unions.

The group, led by Trillium Asset Management and SOC Investment Group, said Starbucks risked damaging its positive reputation as a pro-employee brand by fighting the union.

Schultz has long said Starbucks did not need unions because it works so closely with employees, whom it calls “partners.”

He has already had a run-in with Workers United, the union now representing employees at six stores. Employees at more than 140 stores in 27 states have asked for union elections in the last 7 months.

In November, Schultz spoke to employees who had been ordered to a large meeting with managers in Buffalo, where the first of Starbucks’ 9,000 U.S. company locations were deciding whether to join the union.

In the meeting, Schultz likened Starbucks’ pro-employee stance to Holocaust prisoners in concentration camps sharing blankets, according to media reports. The remarks led to backlash on social media.

“Schultz came to Buffalo to union-bust,” wrote union organizer Jaz Brisack on Twitter after the news. “His takeover is another move in Starbucks’ ideological war on unions.”

Johnson took the helm after Schultz resigned in 2017.

In a letter to employees on Wednesday, Johnson said that he has “fond memories of making beverages together, laughing together, and sharing stories with one another.”

Starbucks will “attract high-quality CEO candidates given its culture, global brand recognition and strong growth outlook,” said BMO Capital Markets analyst Andrew Strelzik.

Because Johnson had previously worked in technology – at Microsoft and Juniper Networks – the board’s search is likely to be broad. However, “we prefer to see an incoming CEO with strong consumer industry experience,” Strelzik said.

The CEOs of Domino’s Pizza and Wingstop also resigned in the last two weeks.

Former Starbucks chief operating officer Troy Alstead, who left in 2016, “was beloved by the investment community” and “ought to be on the short list” for the CEO role, Cowen analyst Andrew Charles said.

Several internal candidates could be considered, but “unionization publicity could be a factor pushing the company to look externally,” Charles said.

(Reporting by Hilary Russ; editing by Jason Neely and Nick Zieminski)