United States and European officials discussed the possibility of completely banning imports of Russian oil. The move, while not a surprise, sent energy prices skyrocketing. Russian crude accounts for 3% of American imports.

The U.S. energy complex has seen money flow into the space. These companies are leading options to fill the void of Russia’s departure from the global economy.

Exxon Mobile’s (XOM) stock rose to its best level since 2018 on the news. It has rallied 163% since October 2020. Shares are up 42% year-to-date. Is it too late to buy?

Founded in 1870, the energy giant operates across Upstream, Downstream and Chemical segments. It is involved in the manufacture, trade, transport, and sale of crude, natural gas, petroleum, petrochemicals and other specialty products. Basically, it does everything in the energy space.

XOM sports a market cap of approximately $350 billion making it the second biggest energy name on the planet. It is dwarfed by state-run Saudi Aramco which sports a cap of $2.3 trillion.

Last week, the company hosted its annual Investor Day. It outlined strategic priorities to increase shareholder returns, outperform competition and grow value through lower-emissions.

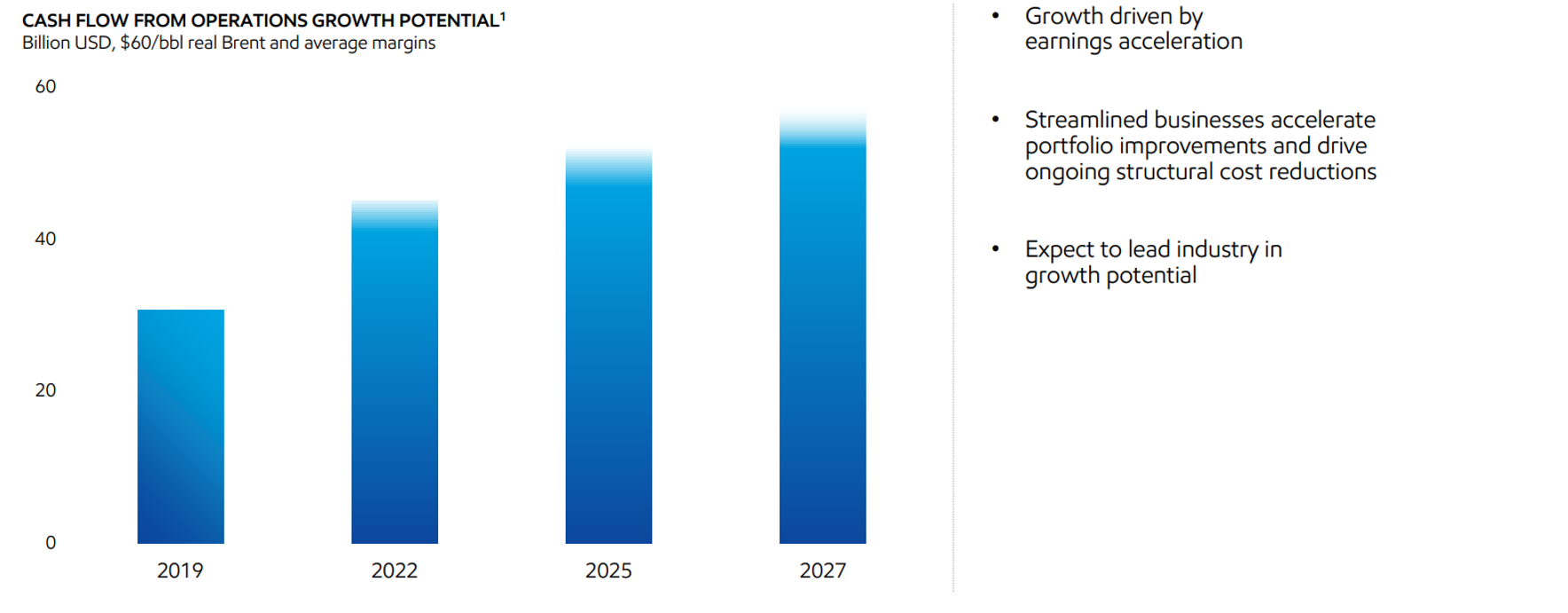

Exxon had a banner year in 2021. It delivered $23 billion in earnings and $48 billion of cash flow from operations. Upstream earnings were approximately $16 billion, its highest since 2014- the last time Russia invade the Ukraine. The company projects Upstream earnings will more than double through 2027.

XOM registered $5 billion of annual structural cost reductions through 2021 and expects an additional $4 billion by 2023. It has held base operations flat as it aims to more than offset inflation and growth. This is key given the rising costs associated with materials.

Its 2022 CapEx is projected to be $21-24 billion. Annual CapEx between 2023-27 is expected to be in the range of $20-25 billion. The investments are directed toward low-cost-of-supply Upstream projects in unconventional, deepwater, and LNG and high-value products including chemical performance.

XOM repaid $20 billion in debt to reduce its debt-to-capital ratio to 21%. XOM is fast approaching the low end of targeted debt-to-capital range of (20-25%). It expects to reduce its debt by another $2 billion in 2022. The balance sheet is in great shape.

The company forecast breakeven at $41 a barrel, meaning oil can see a substantial decline from current levels without disrupting capital return plans. XOM could generate $132 billion in excess cash through 2027 with breakeven at $35 a barrel and brent at $60 per barrel. Over 90% of capital investments generate over 10% returns when oil is above $35 a barrel.

The company did not commit to higher shareholder returns at the Investor’s Day despite the higher oil prices. XOM’s $10 billion share buyback will be over the shorter end of the 12-24 month target. Analysts believe the company could increase buybacks later in the year if prices remain elevated. There is a lower chance of a material dividend increase.

Exxon does not have plans to grow production to take advantage of higher oil prices. This highlights the new gameplan for oil companies. In the past, firms would have piled into new projects, chasing higher oil prices. The new approach highlights a disciplined approach by the industry. It also underscores the lack of development which has led to some of the supply issues we witness today.

The company’s Low Carbon Solutions will play to its strengths as the country undergoes an energy transition. It will also appeal to ESG players. The business focused on CCS, hydrogen, and biofuels. XOM is already a global leader on carbon capture, representing one-fifth of global capacity. XOM plans to achieve net-zero Scope 1 and 2 emissions from operated assets by 2050.

Exxon said it would exit Russia oil and gas operations that were valued at approximately $4 billion and halted new investment in the region. Russia is approximately 1-2% of capital employed and earnings. XOM operates the Sakhalin-1 on behalf of a consortium of Japanese, Indian and Russian companies. The Sakhalin Island project exit will be a “complicated process”. The company owns a 30% share in the fields located in Russia’s Far East. It did leave the door open for possible future investments.

Do you want to buy Exxon now?

Exxon’s industry-leading pipeline of projects drives strong earnings and cash flows. The company is well-positioned to propel further operating costs and capital efficiency gains.

XOM reiterated its long-term outlook from December while providing details on how it will double 2019’s $30 billion cash flow from operations by 2027. XOM plans to reduce annual structural costs by another $4 billion by 2023 as it streamlines organizations and centralizes core capabilities.

It has strong relationships with governments across the World and the financial capacity to lead world-scale capital-intensive developments.

Investors wanted a stronger capital return announcement at Investor Day but the company still sports a very attractive 4.34% yield and could expand its program in the second half of the year.

Energy is up 26% year-to-date, second place is Basic Materials which has only lost 0.26% in 2022, as inflation and geopolitical tensions drive stocks higher. A lot of the news has been priced in to shares. However, oil companies have voiced concerns around the volatility in oil prices and supply chains as it is difficult to manage in this environment. Short-term rates are rising and the Fed is set to tighten in its meeting next week. This will put some pressure on the financial system, another obstacle for markets.

The company sports a healthy return which can offset some near-term losses but, given the run up and near-term risks, we would prefer to stay patient and wait for the stock to ease back to the $75 level rather than chase. If you believe that the capital return can offset near-term risk then a small seed position at these levels would make sense. But we think you can get shares cheaper.