Meta Platforms (FB), the artist formerly known as Facebook, posted a disappointing round of earnings. Investors fled for the hills as the stock tumbled 21%.

To put it into perspective, FB lost approximately $180 billion in market cap last night, roughly the size of AT&T! Does this wash out mean it is time to buy?

It was a terrible quarter for the company. It comes at a time when tech companies will not be afforded a pass by skittish investors.

Earnings were 4% below estimates which was its biggest miss ever. Revenue was slightly better than expected at $33.6 billion. Revenue growth slowed to 19.8%, well below Q3 growth of 35%, Q2 55%, and Q1 47%. The slowdown comes from its advertising unit as it works around the recent Apple (AAPL) iOS changes.

The company expects advertising headwinds to continue. It sees Q1 revenues in the range of $27-29 billion compared to analyst expectations of $30.2 billion. FB stated that impressions would remain under pressure as it sees increased competition for “people’s time and a shift of engagement” toward video.

FB anticipates modestly increasing ad targeting and measurement headwinds from platform and regulatory change. The company is hearing from advertisers that macroeconomics challenges like cost inflation and supply chain disruptions are impacting advertiser budgets. We did not hear this from Alphabet.

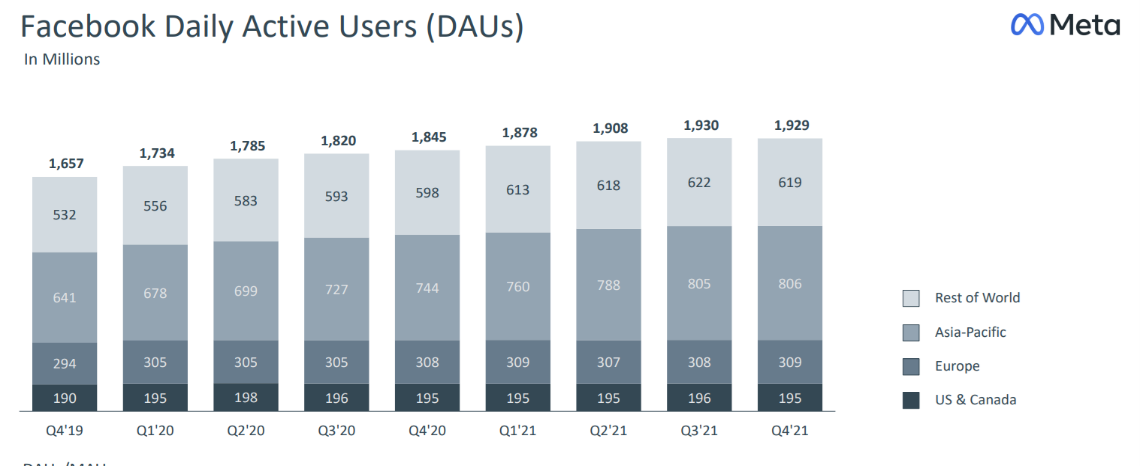

Two key metrics, Daily and Monthly Active Users (DAU and MAU) both missed expectations. Metaverse lost one million daily active users sequentially. This marked its first ever quarter over quarter loss in DAU. MAU growth of 4% fell short of the expected 5% increase.

Analysts are panning the results. BMO Capital Markets downgraded shares to Market Perform from Outperform, lowering its price target to $290. Raymond James cut its rating to Outperform from Strong Buy while lowering its price target to $340. J.P. Morgan downgraded shares to Neutral from Overweight and slashed its target to $284 from $385. I would expect to see other analysts follow.

There are a lot of issues facing Meta as it tries to recover. Alphabet is outperforming FB in ecommerce ads as the Apple restrictions hurt FB models. The company built an ad targeting tool that was taken away from them by Apple. Marketers are taking the ad dollars elsewhere in search of a better return on investment. TikTok continues to take market share as evident by Mark Zuckerberg’s attacks the competitor on last night’s conference call. Lawmakers remain focused on Meta and see it as their favorite whipping boy.

FB has historically rebounded from these issues. Recall in 2018 when the Cambridge Analytica scandal rocked shares. The stock fell from $218 in July of 2018 to $123 in December of that year. That set the shares up for an aggressive two-year rally, hitting an all time high of $384 in September of 2021.

FB may have more wood to chop this time around.

Meta has gone through major transitions before. FB successfully transitioned into mobile advertising a few years ago and it improved monetization in its Stories segment when that challenge arose.

The company is pivoting to drive improvement in its Reels segment to battle TikTok. Mark Zuckerberg stated that this would be a priority for the company in 2022. Unfortunately, video carries a lower monetization.

M&A was a key reason why it was able to improve in those areas as it purchased WhatsApp. It will be tough for FB to go that route as the FTC’s Lina Kahn has vowed to crack down on Antitrust concerns.

The company continues to plow money into its metaverse unit but that is unlikely to have a major impact. J.P. Morgan predicted that the non-advertising dollars will grow in the low-single digits for the company over the next couple of years.

Meta has had success in launching new platforms in the past. There is some advantage to having 3.59 billion MAUs or half the world’s population. It was able to successfully launch Marketplace in 2016 and Shops in 2020.

FB now trades at approximately 17x forward earnings. This is the same level it was trading at in 2018 following the Cambridge issues. Its market cap is now half the size of Alphabet.

Does this open a buying opportunity?

Entertainment companies such as FaceBook, Netflix, and Spotify have shown some cracks. Investors and analysts are readjusting to the new 2022 outlooks. Other tech companies such as Apple, Alphabet, and Microsoft are reiterating their strength.

Given the market volatility, I would prefer to place my money in names performing well. FB is seeing a disruptive headline gap. This technical damage takes time to repair. I would prefer to sit this one out and invest my money in names that are performing. There will be opportunity in Meta Platforms down the road, but I would wait for some confirmation of a bottom before buying shares.