1

1 1

1

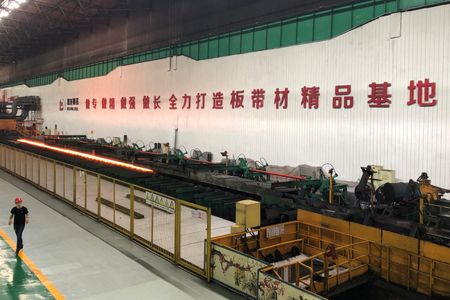

BEIJING (Reuters) – China’s factory activity contracted at the sharpest rate in 23 months in January, underscoring the huge economic costs from the country’s zero-COVID approach as surging cases and tough containment measures weighed on output and demand, a private survey showed on Sunday.

The Caixin/Markit Manufacturing Purchasing Managers’ Index (PMI) fell to 49.1 in January – its lowest level since February 2020, when the economy was still suffering from country-wide COVID-19 lockdowns in the early days of the pandemic.

Economists in a Reuters poll had expected the index to ease to 50.4 from December’s 50.9 but still point to some growth. The 50 mark separates growth from contraction on a monthly basis.

The unexpectedly weak reading is likely to reinforce market expectations that policymakers need to roll out more support measures to stabilise the faltering economy. China’s central bank has already started cutting interest rates and pumping more cash into the financial system to bring borrowing costs down, and further modest easing steps are expected in coming weeks.

A sub-index for factory output stood at 48.4, down from 52.7 in December, with firms surveyed reporting reduced intakes of new business and as a recent surge in COVID-19 cases and tough anti-virus measures impacted production, the survey showed.

Demand also took a dive, as new orders fell at the fastest clip since August this year and export orders shrank the most since May 2020. Exports were one of the few bright spots for China’s economy in the second half of last year.

That led to renewed pressure on the job market, with a gauge for employment dropping to the lowest in almost two years.

“From December to January, the resurgence of Covid-19 in several regions including Xian and Beijing forced local governments to tighten epidemic control measures, which restricted production, transportation and sales of manufactured goods,” said Wang Zhe, senior economist at Caixin Insight Group said.

“It became more evident that China’s economy is straining under the triple pressures of contracting demand, supply shocks and weakening expectations.”

A surge of COVID-19 cases since late December in the manufacturing hub of Xian forced many auto and chip makers to shut operations, although production has gradually returned to normal as the city emerged from a lockdown.

Inflationary pressures also edged higher in January, while manufacturers’ confidence towards the year ahead picked up as firms remain convinced China would be able to get COVID-19 under control.

The world’s second-largest economy got off to a strong start in 2021, rebounding from 2020’s pandemic-induced slump, but it began losing steam in the early summer, weighed down by growing debt problems in the property market and COVID-19 outbreaks that hit consumer spending.

The International Monetary Fund on Wednesday cut its forecst for China’s 2022 growth to 4.8%, from 5.6% previously, reflecting the property downturn and the hit to consumption from strict coronavirus curbs.

The economy grew 4.0% in the fourth quarter from a year earlier, its weakest expansion in one-and-a-half years.

(Reporting by Stella Qiu and Ryan Woo; Editing by Kim Coghill)