1

1 1

1

(Reuters) -Icahn Enterprises said on Thursday it was planning to distribute $2 per depositary unit for the quarter ended March 31, days after short seller Hindenburg’s report sent the investment firm’s shares to more than a-decade low.

Its shares rose 6% after the bell as the company said the declaration of the depositary unit was ahead of schedule due to the inquiries following the report.

Hindenburg had on Tuesday accused the investment firm of over-valuing its holdings and relying on a “Ponzi-like” structure to pay dividends that wiped away a fifth of Icahn’s empire.

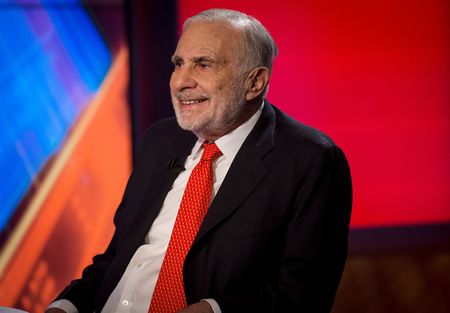

“We would like to reassure our long-term unitholders that the market disruption caused by the self-serving Hindenburg report does not affect IEP’s liquidity,” said Carl Icahn, billionaire activist investor and chairman of Icahn Enterprises.

Icahn said he disagrees with “the inflammatory assertions” in the Hindenburg report and intend to respond at “length – and to vigorously defend IEP and its unitholders”.

Hindenburg did not immediately respond to a Reuters request for comment.

(Reporting by Mehnaz Yasmin in Bengaluru; Editing by Maju Samuel and Arun Koyyur)