By David Shepardson, Eric M. Johnson and Tim Hepher

WASHINGTON/SEATTLE (Reuters) -Qatar Airways handed Boeing Co a record launch order for 34 new 777X freighters and a surprise purchase of 737 MAX passenger jets on Monday, in a $30 billion-plus package as President Joe Biden hailed the Gulf state as a major U.S. ally.

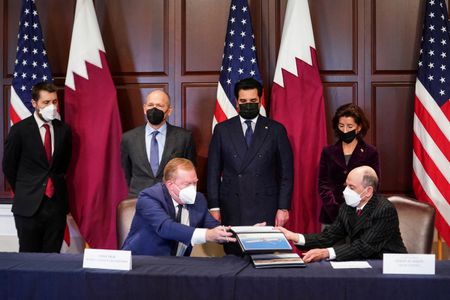

The deal, signed at the White House during a visit to Washington by Qatar’s ruling emir, boosted Boeing at a time when the U.S. planemaker faces chronic industrial and financial constraints. The order drove Boeing shares up to close 5.1% higher.

The deal for 25 of the largest version of the MAX, the 737-10, plus 25 further options, widened the fallout from a dispute between Qatar Airways and Airbus .

The European planemaker earlier this month revoked a contract with Qatar Airways for 50 competing A321neo jets as part of a spiraling dispute that began with disagreements over the severity of flaws on long-haul A350 jets.

Qatar Airways Chief Executive Akbar Al Baker said Qatari and U.S. aircraft and engine negotiators had “lost a lot of sleep” in the intervening two weeks to shape an alternative deal, and contrasted that with a recent plunge in relations with Airbus.

“We like to build long-term relationships with trusted partners where both parties work together towards a common purpose,” he told a White House signing ceremony attended by leaders from Boeing and engine maker General Electric Co.

Airbus declined comment.

The total order included 34 of a newly launched freighter version of the 777X passenger plane, plus 16 options, and two more of the current-generation freighter, the 777F. Reuters reported https://www.reuters.com/business/aerospace-defense/qatar-airways-order-up-50-boeing-737-max-source-2022-01-31 the 737 MAX deal earlier on Monday.

The freight part of the deal represents the first order for a cargo spin-off of the 777X, the world’s largest twin-engine passenger plane whose entry to service has been delayed more than three years to late 2023 or beyond.

Boeing said the freighter would enter service in 2027.

It is banking on sales of the new twin-engined juggernaut to defend its dominance of the cargo market and head off a challenge from a new Airbus A350 freighter.

“(The 777X) will be an absolute world-beater,” Boeing Chief Executive Dave Calhoun said.

ORDER CONVERSIONS

To win the freighter order, Boeing agreed to convert a third of Qatar’s existing order for 60 777X passenger planes, for which there is currently less demand, to the cargo version.

Al Baker played up support for the U.S. economy from Qatar Airways, which has faced trade complaints in the past from U.S. carriers over alleged subsidies – a practise it denies.

For Boeing, the deal marks a respite from a recent safety crisis over the MAX and delays with the 777X passenger jet and 787 Dreamliner, and a chance to win points for its own economic contribution after intense regulatory and political scrutiny.

Qatar Airways had criticized the MAX and urged Boeing to design an all-new jet after crashes led to a lengthy grounding, but sales have rebounded since it was re-cleared in late 2020.

The Airbus A321neo continues to dominate sales in the part of the market served by the largest MAX variant, however.

Boeing said the freighter order would sustain more than 35,000 U.S. jobs with an annual economic impact of $2.6 billion.

Boeing has dominated air freight for years through its 767, 777 and 747 cargo jets, though it will be urgently pressing for more orders for the new freighter flagship.

About half of global cargo by value travels by air, and in turn half of that usually goes in the belly of passenger planes.

During the pandemic, many airlines have been forced to park unused passenger jets, driving up demand for cargo space at a time when e-commerce has been a lifeline for many.

But economists warn the trends could start to unravel as the pandemic eases.

(Reporting by David Shepardson in Washington, Eric M. Johnson in Seattle, Tim Hepher in ParisAdditional reporting by Alexander Cornwell in DubaiWriting by Tim Hepher, Eric M. JohnsonEditing by Tomasz Janowski, Matthew Lewis and Lincoln Feast)