1

1 1

1

By Naomi Rovnick and Ankur Banerjee

SINGAPORE, LONDON (Reuters) -Global equities traded sideways on Wednesday after enthusiasm about China lifting COVID restrictions was tempered by rising infections and investors’ gloomy outlook for Western economies.

MSCI’s broadest index of global stocks was flat as investors stayed on the sidelines at the end of a brutal year for equities. The global gauge is on course to end 2022 19.5% down, in its worse performance since the financial crisis of 2008, having buckled under the pressure of red-hot inflation in Western economies, major central banks hiking interest rates, and China’s stringent zero-COVID policies.

Futures tracking Wall Street’s S&P 500 share index and contracts on the tech-heavy Nasdaq 100 both added 0.3%.

Europe’s broad STOXX 600 also ticked 0.3% higher, but was still on course for its worst year since 2018.

China’s government announced on Monday it would stop requiring inbound travellers to go into quarantine starting from Jan. 8.

While China’s health system has come under heavy stress from the lifting of restrictions so far, strategists at JP Morgan forecast a “likely infection peak” during the Lunar New Year holiday next month, followed by a “cyclical upturn after nearly three years of on and off restrictions.”

While a rebound in China may help the world economy avoid a hard landing, investors are not sure it will be enough to offset the impact of the U.S. Federal Reserve and the European Central Bank continuing to raise borrowing costs.

“It’s probable the recession itself will be shallow but the key word is stagnation, so it’s hard to see a high level of growth in the next couple of years,” said Francesco Sandrini, head of multi-asset strategies at European fund manager Amundi.

In fixed income, euro zone debt struggled to recover significantly from a selloff triggered by hawkish rhetoric from the European Central Bank at its December monetary policy meeting.

The two-year German government bond yield, which tracks interest rate expectations, hovered just below a 14-year high reached in the previous session, at 2.636%.

The 10-year German yield, a benchmark for euro zone borrowing costs, inched 5 basis points lower to 2.463%, trading around levels last seen regularly during the European debt crisis of 2011.

The yield on 10-year U.S. Treasury notes was down 2 basis points to 3.837%, hovering around the five-week high of 3.862% it touched in the previous session.

The two-year U.S. Treasury yield was down 3 basis points at 4.429%.

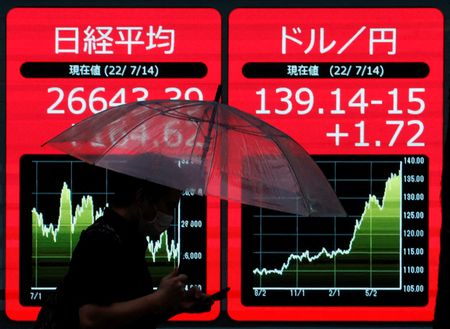

In foreign exchange markets, the yen weakened 0.3% to 133.9.00 per dollar, in a partial reversal of strong gains for the Japanese currency after the nation’s central bank made a hawkish tweak to its controversial “yield curve control” policy that suppresses domestic borrowing costs.

The index that measures the safe-haven dollar against six major currencies was steady at 104.1, down about 9% since late September when markets began looking ahead to a peak in inflation that might prompt the Fed to stop hiking rates.

Brent crude, the global oil benchmark, dropped 0.9% to $83.55.

(Reporting by Ankur Banerjee, Naomi Rovnick; Editing by Bradley Perrett and Tomasz Janowski)