Shares of Tesla (TSLA) rallied 5% after reporting first-quarter deliveries that were in line with expectations. Investors worried that supply chain issues would lead the EV maker to miss its output target. The better-than-feared number provided some relief.

The rally made Elon a cool $9 billion in net worth. Life is good when you are a 17% stakeholder in one of the hottest companies on the planet.

The funny thing is it was a $1.3 billion gain from a 9% stake in another company that grabbed the market’s attention.

In an SEC Filing, Elon Musk disclosed a purchase of 9.2% in Twitter (TWTR) stock. This makes Musk the largest shareholder in the company.

Musk did not disclose what he paid for the shares. The purchase was made in the middle of March which suggests an initial value of approximately $2.3 billion. Shares of TWTR rallied 27% in reaction to the news which puts Elon’s stake at approximately $3.6 billion.

A hell of a day.

But we do not want to discuss a billionaire having a good day. We want to figure out a way to profit from this volatility and see if we should join Musk on his gambit.

Elon Musk is widely followed and has a zeitgeist appeal beyond the business world. He has 80 million Twitter followers, far more than any other CEO (Bill Gates 57 million, Active is Tim Cook with 12+ million). A high-profile stake garners plenty of attention from investors, particularly from the retail class.

Musk did not disclose his intentions in the filing. Technically, a position below 10% is considered a “passive” stake on the street. Very little about his personality suggests he will be a quiet investor looking for dividend checks.

Musk has been a high-profile critic of Twitter policies in the past. Last month he said he was giving “serious thought” to creating a new social media company. Wedbush Security tech analyst Dan Ives believes “he intends to go active and force change at Twitter”.

The Tesla CEO recently ran a Twitter poll asking his followers if they believe TWTR adheres to the principle of free speech. Over one million responded, 70% said ‘no’. The second question was whether its algorithms should be open source. 83% responded ‘Yes’. Elon Musk is in line with a decentralized Twitter where people can build on it and create their own rules.

He followed up his poll by posting, “The consequences of this poll will be important. Please vote carefully”. That comment takes on added significance after his stake was revealed.

It is worth noting that activist investor Silver Lake forced Twitter to give it board seats back in March 2020. Silver Lake acted as the advisor to Elon Musk when he explored taking Tesla private. We should not be surprised to see this morning’s announcement that the Twitter Board will take the necessary actions to appoint Musk as a Class II director with a term expiring at the company’s 2024 annual meeting of stockholders.

Musk agreed that, as long as he is serving on the board, he will not, either alone or as a member of a group, become the beneficial owner of more than 14.9% of common stock.

Twitter has lost half of its value since February of 2021. The company has had difficulty monetizing its platform. The problem is it is a hard service to use, and it has not been optimized by advertisers. Twitter has not participated in the direct response click boom like peers Google (GOOGL) and Meta Platforms (FB).

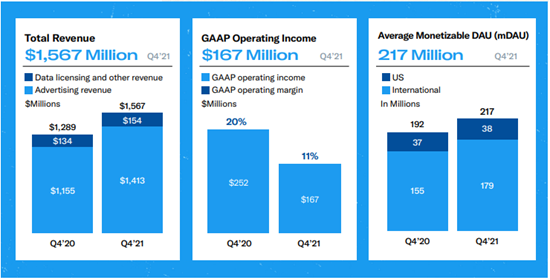

Q4 revenues increased 22% y/y, a deceleration from 37% in the third quarter. The fiscal year 2022 Ad revenue guidance was modestly below expectations due to the impact of Apple’s iOS changes. Operating income declined on a y/y basis with margins falling to 11% from 20%, reflecting higher spending to build out product innovation.

U.S. monetizable DAUs grew 13% y/y, in line with expectations, but well behind the company’s long-term target of 20% CAGR . User growth in the higher valued U.S. was notably slower than International growth. User growth needs to pick up before investors will get behind the stock.

The direct response program made progress, but many doubt the company’s ability to hit a 2023 target of 50% performance advertising and accelerate growth in the Dr business. TWTR is highly focused on e-commerce ad units within its Dr offerings, so this will be important to monitor.

Founder Jack Dorsey stepped down as CEO last November. Parag Agrawal, the chief technology officer, stepped into the role. A major focus for both CEOs has been to revitalize Twitter’s product innovation. The company has worked hard to improve its services for advertisers.

Dorsey and Musk are friendly so it would be interesting to see if he and Agrawal would be open to Elon’s suggestions for changing the overall business model of the company.

As for potential investors, one must ponder what the process of implementing Musk’s plan looks like. How easy of a transition would it be from its current ad-based model. Most importantly, how long would it be until Twitter, hopefully, saw improved results and earnings power.

Shares of TWTR rallied 27% following the news of the SEC filing. The stock is up 61% since the middle of March. Prior to its rally, analysts were able to make the argument that the stock was cheap. That is no longer the case. The price to forward earnings is now 33x and its price to sales is at 6x.

As for investors, the first big hurdle is holding that gap $47 support area. The stock looks ready to retain that area after shares extend gains this morning to push above the 200-SMA ($52). This means there is ample space for profit-taking without disrupting the chart and breaking below support.

We are seeing signs of profit-taking following that initial break above the 200-SMA. The slip back to $52 sets up as the first area of defense for bulls. If the stock fails to hold then we could see more investors head for the exit. This could set up for an important test of $47.

It would not be a surprise to see a lead blanket offering around $55 given concerns around the operations. TWTR is set to report earnings on April 28 and there will be skepticism even as Elon Musk joins the Board. This makes it difficult to chase the name if you have a longer-term investment horizon. We would prefer to see these results cross wires and look for a pullback to create a better entry.

The good thing about this trade is your risk is well-defined. A break below $47 support will raise a red flag. Holding that level will suggest a basement for the stock until we get further evidence of improving results.

Investors will have to embrace Musk’s involvement in the company. While being a successful CEO at Tesla, he would be new to the advertising and social media space. His success would not be guaranteed but his followers would put money to work and strengthen the $47 support level.

So, if you are looking to invest in the name, be prepared to average down with an understanding that near-term headwinds could lead to profit-taking after its recent gains. However, the involvement of Elon Musk will bring a new class of investors and help provide a higher floor in the stock.