1

1 1

1

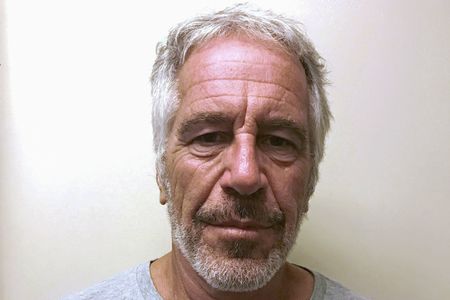

NEW YORK (Reuters) -A U.S. judge on Monday granted preliminary approval to JPMorgan Chase’s $290 million settlement with women who said Jeffrey Epstein abused them, and that the largest U.S. bank turned a blind eye to the late financier’s sex trafficking.

The approval was issued by U.S. District Judge Jed Rakoff at a hearing in Manhattan federal court.

Epstein had been a JPMorgan client from 1998 through 2013, when the bank terminated his accounts.

Victims led by a former ballet dancer known as Jane Doe 1 said JPMorgan missed red flags of Epstein’s abuses, and stayed in touch with him long after his official departure.

Lawyers for the victims said last week that the proposed all-cash settlement was “fair, adequate, reasonable” given the risks of further litigation and JPMorgan’s denying involvement in Epstein’s sex trafficking.

JPMorgan in a statement this month said any association it had with Epstein “was a mistake and we regret it.”

Epstein remained a JPMorgan client for five years after he pleaded guilty in 2008 to a Florida prostitution charge and registered as a sex offender.

He died at age 66 in a Manhattan jail cell while awaiting trial on sex trafficking charges. New York City’s medical examiner called the death a suicide.

(Reporting by Luc Cohen and Jonathan Stempel in New YorkEditing by Chris Reese and Matthew Lewis)