1

1 1

1

By Padraic Halpin, Conor Humphries and Richa Naidu

DUBLIN/LONDON (Reuters) – Global retailers and consumer goods makers remain in crisis mode and expect consumer behavior to remain unpredictable for the foreseeable future, top industry executives told a conference in Dublin this week.

Since the start of 2020, the STOXX Europe 600 Retail EUR Price Index has lost more than a fifth of its value. The equivalent index for European food and beverage makers <.SX3P) is down more than 4%.

In that time, political tensions have risen; climate change has entered “another stage of crisis”; the macro-environment has changed dramatically; and the Covid-19 pandemic is still ongoing, Carrefour Chief Executive Alexandre Bompard said at the Consumer Goods Forum’s Global Summit on Tuesday.

“For us as CEOs, it means that crisis is the new normal,” Bompard said. “What we have been used to in the last decades – low inflation, international trade – it’s over. It’s not the new world.”

A desperate supply chain crunch has also sent shudders through the manufacturing and consumer goods industries over the past year, with shipments trapped in log jams due to factors including pandemic lockdowns, panic buying and sanctions levied on Russia for its invasion of Ukraine that began in February.

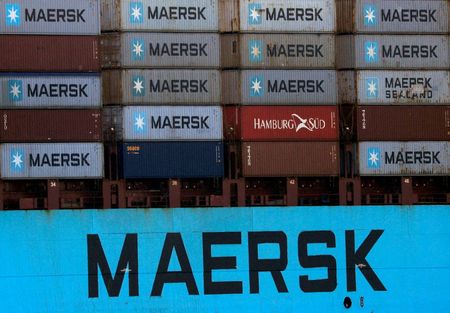

Logistics giant Maersk, which transports goods for companies like Walmart and Nike said the cost of shipping cargo is up 25-30% due to an array of inflationary pressures that are “unlikely to abate in the short term.” [L1N2Y90UZ]

Consumer goods companies should get used to the idea of “crisis being more or less the new normal” as they fight soaring inflation, climate change and a global food crisis, Unilever chief Alan Jope said on Tuesday.

“The mother of all crises is of course the climate emergency,” he said.

The problems have contributed to mounting inflation.

“Inflation is a dynamic, particularly in Europe, that we need to start to get used to,” Ayla Ziz, Danone’s global head of sales, told Reuters ahead of the conference.

Tobias Wasmuht, Chief Executive of SPAR International, said the supermarket chain owner is trying to mitigate the impact by cutting costs and becoming more efficient but warned that rising ingredient and raw material costs will be passed on to shoppers.

(Reporting by Padraic Halpin and Conor Humphries in Dublin and Richa Naidu in London; Editing by Matt Scuffham, Alexandra Hudson)